Finance Information

-

Transfer Errors Prevention and Response Measures

Transfer Errors Prevention and Response Measures

View Detail ① Prevent Transfer Errors

① Prevent Transfer Errors

Before the press Transfer button finally, check Recipient Information once again.

When transferring electronic funds, we have the procedure to provide the information you have entered to confirm it once again.

* Four pieces of Recipient Information are needed to check once again before pressing Transfer button finally

Name, Bank, Account Number, Price ② Prevent Transfer Errors

② Prevent Transfer Errors

Take advantage of frequently used accounts, favorite accounts, etc.

Through Online banking and smartphone banking, we provide the function to inquire recipient information that has been completed in the past and to register a frequently used account. ③ Prevent Transfer Errors

③ Prevent Transfer Errors

Actively utilize the protection function for transferors, such as delayed transfer.

We provide "delay transfer service" which able to deposit into recipient account after a certain time. If you apply for a delayed transfer service, you will be able to have time available for cancellation since it deposited into the recipient account at least three hours later.

① Response on Transfer Errors

① Response on Transfer Errors

Please contact the call center to request a refund.

If you send the wrong money to others, you can proceed "transfer error returned claims procedure ‘through Finance companies. The Return claims procedures are processed through application of the sender errors and the payee Return agree then funds will be returned.

* You can also contact the call center to request for non-business hours such as evenings, weekends, holidays, or in case of difficulty to visit. ② Response on Transfer Errors

② Response on Transfer Errors

Please contact the money transfer financial company which proceeded the transfer business when requesting a refund.

In case of a mistransferring return claim, the application can be made through the 'Finance Company' that has processed the transfer business according to the procedure. Therefore, in order to receive a return claim, you must contact the financial institution that submitted the remittance. ③ Response on Transfer Errors

③ Response on Transfer Errors

If inevitable, proceed with a lawsuit to file the 'unfair profits return claim'.

If the recipient's contact is a old contact, or if there is a legal limitation, such as the withdrawal of his or her account, it may be difficult to return it via the return claim process. In such a case, the recipient may receive the funds back through a 'unfair profits return claim'. Transfer Errors

Transfer Errors

Remember these preventions and response measures then have Secure financial transactions!

Source : Financial Supervisory Service

※This content is provided by Webbright Inc. in partnership with IBK Industrial Bank.

-

Top 5 cases of dormant deposits

Top 5 cases of dormant deposits

View Details! ① "School of Banking" made for children

① "School of Banking" made for children

Parents with elementary, middle and high school children pay for school meals and field trips using school banking, and often left their children's account open even after they graduated. ② "Wage bankbook" made during military service

② "Wage bankbook" made during military service

In the past, when men deployed to each base, the Unit opened a bank account for a their unit transaction and used it as a payroll account. As a result, they often don't use their payroll account when they finished their services. ③ “Scholarship Fund" left unattended after school transfer

③ “Scholarship Fund" left unattended after school transfer

According to the school's recommendation, students are encourage to make the scholarship funds for them to be useful when they go to a higher school, but once they moved to new school, they often forgot about their scholarship fund. ④ “Interest automatic transfer account“ when receiving loans

④ “Interest automatic transfer account“ when receiving loans

Saving installment and trust products cannot change their transaction bank, so even if the main bank is changed, people have to engaged previous bank until maturity. As a result, valuable money is often left unattended because people forgot the fact that they subscribed a account or have not informed of its full period. ⑤ Forgot “Long-term·Savings Installment" after changing Main Bank

⑤ Forgot “Long-term·Savings Installment" after changing Main Bank

Saving installment and trust products cannot change their transaction bank, so even if the main bank is changed, people have to engaged previous bank until maturity. As a result, valuable money is often left unattended because people forgot the fact that they subscribed a account or have not informed of its full period. 3 steps to find my hiding money

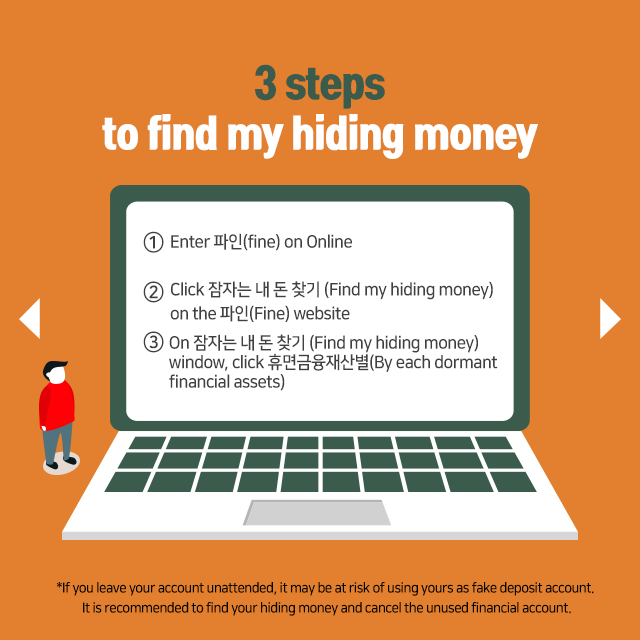

3 steps to find my hiding money

(1) Enter 파인(fine) on Online

(2) Click 잠자는 내 돈 찾기 (Find my hiding money) on the 파인(Fine) website

(3) On 잠자는 내 돈 찾기 (Find my hiding money) window, click 휴면금융재산별(By each dormant financial assets)

*If you leave your account unattended, it may be at risk of using yours as fake deposit account. It is recommended to find your hiding money and cancel the unused financial account. You must! check whether you have hiding money on your accounts and clear your Unused financial accounts!

You must! check whether you have hiding money on your accounts and clear your Unused financial accounts!

Source : Financial Supervisory Service

※This content is provided by Webbright Inc. in partnership with IBK Industrial Bank.

-

100% usages of bank transactions A useful service to know

100% usages of bank transactions A useful service to know

View Details! ① Deposit and withdrawal details notification service

① Deposit and withdrawal details notification service

Consumers who want to check the deposit and withdrawal details immediately can apply for the "deposit and withdrawal details notification service" to their transaction bank. Separately, banks provide services that notifies them immediately when major transactions occur, such as changing their account password and reissued lost bankbook.

* This service is provided by mobile phone text transmission system, so you might pay a certain fee. ② Automatic transfer and reservation transfer service

② Automatic transfer and reservation transfer service

Consumers who wish to transfer the same amount regularly, such as monthly rent, allowance, and membership fees, to the same account can benefit from applying for "automatic transfer service" for their transaction bank.

* “They also provided “Scheduled transfer service," which transfer funds to the scheduled date, rather than a specific period. ③ Bankbookless and cardless withdrawals service

③ Bankbookless and cardless withdrawals service

If you apply at bank branch or from an app service provided by the bank in advance, you can still withdraw or transfer cash from ATM* of the bank where you opened accounts, even if you have left your bank book or card.

* Access to ATMs of other banks is restricted. ④ Increase excess transfer limit service

④ Increase excess transfer limit service

If you need to transfer more than the limit of your account transfer of online banking, visit your bank account in advance and apply for an increase in your transfer limit* then you can transfer a large amount to for online banking.

* When applying for Increase Bank transfer limit, you may be asked to provide the relevant documents. ⑤ Cash exchange service for cashier's checks at other bank branch

⑤ Cash exchange service for cashier's checks at other bank branch

If you need to cash your cashier's check immediately, but you don't have a bank branch with issued check nearby, you can use this service to immediately cash your check at another bank's branch.

*Fees may be incurred when using this service, so check the fees in advance. ⑥ Issuing certificates Online Service

⑥ Issuing certificates Online Service

Consumers who need various certificates such as financial transaction confirmation and debt certificate can issue certificates online without having to visit the bank branch if you already signed up for Online banking. Use 6 services offered by banks to help you transaction!

Use 6 services offered by banks to help you transaction!

Source : Financial Supervisory Service

※This content is provided by Webbright Inc. in partnership with IBK Industrial Bank.

-

Five Financial Plans for Children

Five Financial Plans for Children

View Detail! ① Child-only installment savings and financial voucher

① Child-only installment savings and financial voucher

We are offering a special installment savings package for children featuring cartoon characters to help them develop economic concepts, and also with additional services.

In addition, it is useful to use a financial voucher that supports 10,000 won when you subscribe to a savings account in the name of a infant and child.

* Financial voucher is?

This program is designed to encourage childbirth that when mother created first bank account under the name of children, 10,000 won is deposited. ② Comprehensive housing subscription deposit account

② Comprehensive housing subscription deposit account

Since you can join the bank in the name of a child, it is recommended that you sign up for a Comprehensive housing subscription deposit account, which is a necessary account for your children's homes.

* Even though the number of payments made before the coming of age exceeds 24 times, it is recognized that the payment was made only 24 times. ③ Children Funds

③ Children Funds

When you join a child fund for financial education purposes, you should subscribe to a fund that is easily understandable to your child. You can maximize the effectiveness of financial education if you subscribe, manage, and analyze it with your children.

* Be sure to remember that funds are performance dividend products whose operating performance differs from bank deposits. ④ Children(saving)insurance

④ Children(saving)insurance

Insurance products guarantee life risks such as fracture and burn. In the case of pre-birth fetuses, you must sign up through a special agreement. And, if you consider a lump sum for your child, it's useful to take advantage of child savings insurance.

* Children's Savings Insurance has a long insurance contracts with a huge disadvantage when early termination. Therefore, long-term maintenance is recommended. ⑤ Check cards

⑤ Check cards

Because payment is only possible within the savings account balance range, it is useful for children to form a reasonable spending habit and helps them learn about their spending by checking their credit card statement. Make sure to get benefits of the five products when you apply financial plans for children!

Make sure to get benefits of the five products when you apply financial plans for children!

Source : Financial Supervisory Service

※This content is provided by Webbright Inc. in partnership with IBK Industrial Bank.